Tax Free Exits

Redeemable Preferred Stock — The Preferred Structured Exit?

Social enterprises present many unique business and legal challenges, including with respect to investment structures. Social enterprise investment structures must be designed to facilitate funding, compensate investors for risk, and align incentives. The most common forms of exits, however, for early-stage companies — public offerings and strategic acquisitions — may be unavailable (or undesirable) for social enterprises. Some social enterprise investors are starting to address these goals and restraints using investments with “structured exits,” which are pre-defined and legally enforceable paths to investor liquidity in which the company (rather than third party buyers) redeems investors.

Of course, almost every debt or lending vehicle provides a structured exit, but loans can present challenges when trying to invoke payment flexibility and comply with usury laws. Variable interest payments, for example, can trigger complex tax reporting requirements under the “original issue discount” rules (which apply to all but the most straightforward lending arrangements). While no silver bullet is available, we have found that redeemable preferred stock may provide a satisfactory balance between payment flexibility and simplicity of taxation if properly structured. Furthermore, this type of equity may qualify for tax advantages that could significantly raise expected after-tax return on investment (relative to debt arrangements and equity investments of traditional issuers).

As equity, redeemable preferred stock can carry a cumulative dividend that functions much like accruing interest, but which doesn’t automatically trigger a default upon non-payment. The issuing company may pay this cumulative dividend regularly or upon a pre-planned redemption. Like convertible debt, it can have a liquidation preference and liquidation premium, and/or may participate with the common stock on liquidation (for example, on an “as converted” basis). Essentially, redeemable preferred stock permits a wide variety of repayment methods.

General Tax Treatment

U.S. tax rules treat preferred equity very differently from debt. First, the tax code generally characterizes interim payments on equity as dividends, which under current law are often eligible to be taxed at the lower long-term capital gains rates as “qualified dividend income.” Second, the rules generally tax investor gains on stock redemptions as capital gains. Therefore, equity investors potentially receive all investment gains subject to the lower long-term capital gains rates. Additionally, equity investors can reduce tax exposure under two regimes that potentially apply to early-stage investments:

1. Tax Exclusion of Gains from Qualified Small Business Stock (“QSBS”)

Very generally, the tax code excludes up to $10 million per year of gains from the sale or exchange of QSBS. The tax code imposes numerous requirements for QSBS treatment (too many to discuss here), but most stock issued directly by small U.S. corporations engaged in active, non-professional businesses may qualify. For these purposes, “small” means the corporation must never have had aggregate gross assets of more than $50 million through the time immediately following the stock issuance.

2. Ordinary Loss Treatment for Small Business Stock (“SBS”)

The tax code also extends favorable treatment when an investor incurs losses on SBS. SBS has most of the same requirements as QSBS, except that “small” for purposes of SBS means the domestic corporate issuer must not have accepted aggregate capital contributions of more than $1 million through the time of issuance of the stock. Where applicable, investors may annually treat up to $100 thousand of losses on SBS as ordinary losses, eligible to offset ordinary income. This provides dual benefits of being deductible without limitation by the amount of capital gains recognized in the same year as well as offsetting ordinary income typically taxed at higher rates.

3. ILLUSTRATION — ROI as affected by QSBS and SBS Tax Regimes

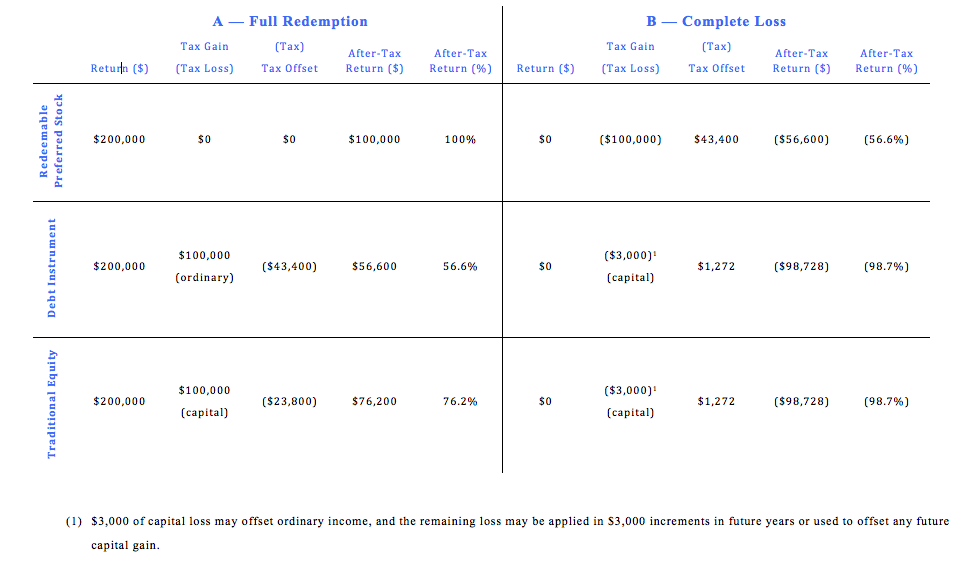

Consider a $100 thousand investment in redeemable preferred stock that is redeemed by the company after 5 years at a 2x return. The following table summarizes the potential after-tax return in both the situation where the stock is redeemed as planned five years after issuance (column A) and also where the venture fails and there is a complete loss of investment (column B). The table also compares the after-tax treatment to that of a similarly structured debt instrument as well as a more traditional investment ineligible for QSBS or SBS treatment. (These figures assume that in the year of redemption the investor is subject to U.S. federal income taxes at the highest marginal rates, files a joint return, has at least $100 thousand of ordinary income, and sells no other investments that year.)

In our field, I hope that means that investors might make investments that they would otherwise be discouraged from making because the risk premium is perceived as too low, or perhaps even agree to a lower cash return (with more money re-invested in impact) because their aggregate, after-tax return could increase substantially with this new law.