Founders of Nonprofits Ask: Which Tax-Exemption Application Should I File?

The IRS provides two forms of its Form 1023: Application for Recognition of Tax-Exempt Status, and most organizations seeking tax-exemption under Section 501(c)(3) will need to file either the standard, “long form” Form 1023, or the much shorter, “streamlined” Form 1023-EZ (though a handful of organizations may qualify for tax-exempt 501(c)(3) status without filing either of these forms).

Below are a few FAQs by nonprofit founders considering their options:

1. Is my nonprofit eligible to use the shorter, “streamlined” application?

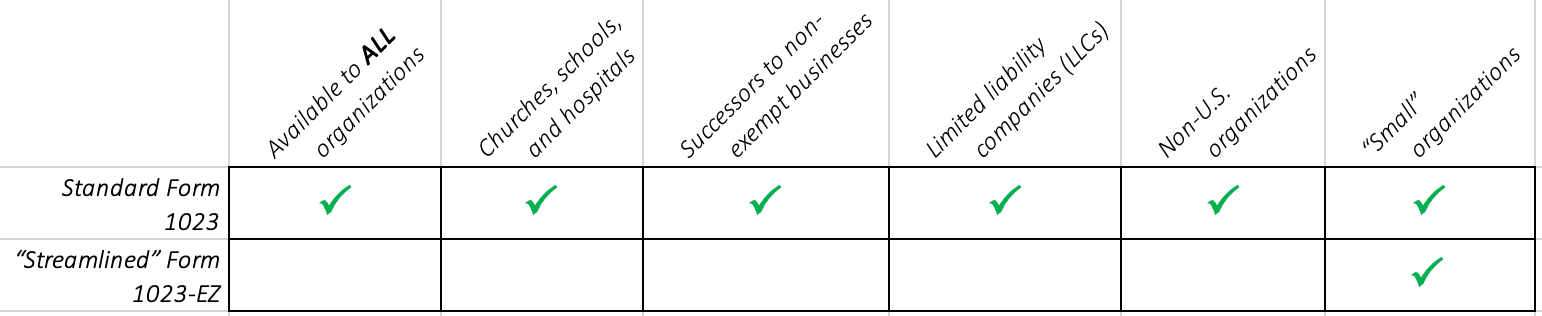

This chart summarizes the eligibility for most common nonprofit social enterprises:

For these purposes, a “small” organization is one that both: (1) anticipates annual gross receipts in the first 3 years of $50,000 or less, and (2) has less than $250,000 in assets.

For these purposes, a “small” organization is one that both: (1) anticipates annual gross receipts in the first 3 years of $50,000 or less, and (2) has less than $250,000 in assets.

2. What are the key differences between the two application forms?

The first major difference is cost, with the “user fees” for the Form 1023 and Form 1023-EZ being $600 and $275, respectively.

Additionally, the complexity of the forms differs greatly. A typical long-form Form 1023, together with all the attachments and exhibits, is typically a roughly 100-page submission that takes between 2-6 months to complete. By contrast, the Form 1023-EZ submission is a web-based, 8-question, yes-or-no exercise, that most people complete in 5-10 minutes.

3. If I’m eligible for the shorter, “streamlined” Form 1023-EZ, should I consider using the full Form 1023 instead?

First, I’d note that the IRS’s goal in offering the “streamlined” Form 1023-EZ was to more easily allow smaller, cash-strapped enterprises to obtain tax-exemption and then “prove their model” over the subsequent years. In other words, the goal was to remove the application from the list of reasons a start-up nonprofit may fail.

However, some nonprofits eligible to make the smaller filing may benefit from using the longer Form 1023 for a couple reasons:

A. Organizations that grow rapidly will soon be required to develop the same information that would have been required on the full Form 1023

In addition to the tax-exemption application, most nonprofits are required to file annual returns with the IRS. For early-stage social enterprises, the applicable forms are either a Form 990-N (“e-postcard”) or a Form 990-EZ:

| IF YOU WERE: | THEN YOU’RE LIKELY: | |

| Eligible for Form 1023-EZ | Eligible for Form 990-N | |

| Required to use Form 1023 | Required to use Form 990-EZ (or Form 990) |

Importantly, the Form 990-EZ requires a lot of information and disclosures that would have been developed or already prepared in the course of preparing the full Form 1023. Organizations that apply for tax exemption using the “streamlined” Form 1023-EZ, but then experience early growth that precludes them from filing a Form 990-N annual return, will need to develop and draft a lot of materials they otherwise would have already done had they filed the long Form 1023. This can be a difficult exercise, particularly if there’s a tight filing deadline and no established relationship with a legal or tax professional that prepares these types of disclosures.

B. Donors and makers of grants are often deterred by the streamlined Form 1023

Some donors prefer not to donate or grant to organizations that use the streamlined Form 1023 application, notwithstanding that there is no legal difference in the tax-exempt status based on which application was used. Many donors and grant makers refer largely to an organization’s documents on file with the IRS in determining the amounts and terms of grants and donations. For new organizations, the long Form 1023 is often the most substantive document on file with the IRS that formally describes the charitable purposes and programs of the organization.

Makers of grants have expressed concerns that organizations filing the streamlined Form 1023-EZ suffer from either: (1) a lack of written record of their charitable bases with the IRS, and (2) a lowered commitment to investing in and developing the infrastructure of the organization. An organization can sometimes overcome these perceptions and convince a hesitant grant maker, but this may require a higher level of effort than would have been required to use the standard, long Form 1023.

C. The IRS has indicated they will more closely scrutinize organizations that use the streamlined Form 1023-EZ

The IRS is notoriously slow to act, but it did indicate that it would start to “check-in” on organizations filing the streamline Form 1023-EZ application after 3 years from filing. The earliest that the IRS would have started these special audits was 2017, and we haven’t yet seen a lot of IRS attention. However, given the usual delays with the IRS, it is still possible the agency may undertake increased audits of these applicants in future years.

In conclusion, we do believe there are certain circumstances where an organization should avail of the newer, streamlined Form 1023-EZ. However, there are some disadvantages to the short-form approach. While most founders come to us already aware of the cost and time savings of the streamlined approach, we encounter very few that are aware of these disadvantages relative to the standard, long-form approach.